By Thomas Shafer

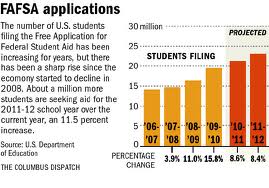

Nationwide many undergraduate-college students take out student loans. According to the Free Application for Federal Student Aid, 58 percent of these students borrow money for their educations. The question that many students face is whether or not to go into debt to cover school.

Within the Nevada System of Higher Education, including students at the College of Southern Nevada, 46 percent of financial-aid awards is comprised of loans, not grants or scholarship.

CSN student Lilia Tomblin receives governmental-student loans to cover her education. Tomblin is one of many students who would struggle to go to college without help from loans. Low interest rates on these loans make them a more viable option, in terms of debt, for her.

“These loans are the only way I could afford an education. I want my kids to have no excuses in the future. I want them to know I graduated and got a degree,” Tomblin said.

In June 2012, congress kept school-loan interest rates to 3.4 percent instead of doubling them to 6.8 percent, which was being considered, according to the U.S. Department of Education.

In the 2010-2011 school year, the NSHE financial-aid report showed that $250 million dollars in loans were disbursed, almost doubling from the 2006-2007 school year.

With the amount of loans on the rise, students should be educated about the debt they take on.

CSN student Allen Brendle commented on this. “I took out loans for two years at CSN and am already $15,000 in debt. I wish I wouldn’t have taken them out because I don’t even have a job and I’m graduating in a few weeks.”

CSN student Max Prague said, “All my friends have taken out loans but I hesitate on them. Something about owing money to school is scary for me. I feel like I’m too young to owe thousands of dollars.”

One of the reasons loans are on the rise is because Pell Grants, a federal financial-aid program that helps low-income students with awards that do not have to be repaid, only cover 32 percent of students’ expenses. This leaves the remainder of the costs to be covered by loans, such as Federal Stafford Loans.

NHSE acknowledges that the maximum award for Pell Grants has risen, but it is not enough.

CSN in 2010-2011 had 18,000 students receiving aid, which is 29 percent of the student population, the lowest out of all schools in the NSHE system, according to the school’s financial-aid report.

According to the Bureau of Labor Statistics, as of October 2012, people with an associate’s degree have an unemployment rate of 7 percent; those with bachelor’s degrees are estimated at 4 percent. Both are below the national unemployment average, showing intrinsic value for degrees. Additionally degreed professionals make more money throughout their careers.

These facts fuel the reasoning behind utilizing student loans to accomplish educational goals. One thing is clear. Loans may provide an opportunity for students to pay for educational advancement though they have to be repaid. Students should understand the pros and cons of taking out loans.